We've said it before and we are saying it again, unfortunately, insurance in California whether homeowner insurance or auto insurance, is not getting any easier. Several insurance companies have recently announced their plans not to renew policies for California homeowners starting in 2024. Among these companies are Merastar Insurance Co., Unitrin Auto and Home Insurance Co., Unitrin Direct Property and Casualty Co., and Kemper Independence Insurance Co. These decisions are attributed to a nationwide restructuring move by their parent company, Kemper Corp, as stated in documents filed with the California Department of Insurance. (More Info) The Hartford Financial Services Group, better known as The Hartford, announced a few days ago that it would no longer issue new homeowners insurance policies in California starting in February 2024. The Hartford noted that it would continue to write new policies for all other types of existing insurance policies in California. In addition, the firm noted that it would continue to renew existing home insurance policies that are consistent with its underwriting guidelines. (More Info)

These developments come after State Farm and Allstate previously announced their decisions to stop accepting insurance applications for all business and personal property in the state. Their decisions were influenced by rising business costs and heightened risks of natural disasters, particularly wildfires, which have become a major concern in the state. California Insurance Commissioner Ricardo Lara has taken steps to increase insurance protections for wildfire survivors, aiming to streamline the claims process and encourage safer practices, such as upgrading roofs and windows to mitigate wildfire risks. While California does not mandate homeowners to have insurance, many mortgage lenders may require proof of insurance as a condition for loans, further emphasizing the importance of these developments for homeowners in the state.

All homeowner insurance companies that are still in California, are implementing stricter rules for reinstatement. More questions regarding the conditions of your home are being asked as well as photograph proof. Home inspections are also becoming a request, especially if you own an older home. Homeowner insurance companies are trying to get rid of more problematic properties due to financial risk.

Besides the homeowner insurance issue, Californians are facing the prospect of substantial car insurance rate hikes as they navigate a dwindling number of insurance options. The state, which once had 15 auto insurers, has now seen that number shrink, highlighting a significant reduction in choices for consumers. Patty Spott, the president of NSE Insurance in Exeter, has voiced concerns over the situation, with some industry experts warning of a possible 35% across-the-board rate increase if approved by the California Department of Insurance. (More Info) This sharp increase in premiums has caught many policyholders by surprise leaving them with unexpected financial burdens. For some, the rising costs of insurance are impacting their ability to afford other expenses, such as vacations, bills, and everyday necessities, underscoring the real-world consequences of the state's insurance woes and the urgent need for a solution to stabilize and make car insurance more accessible for Californians.

The root cause of this insurance crisis in California can be traced back to Proposition 103, which was passed by voters in 1988 with the intention of ensuring fair, accessible, and affordable insurance. Under this legislation, all rate hikes must be approved by the state's Department of Insurance, and any rate requests exceeding 6.9% necessitate a public hearing. This stringent regulatory environment has driven insurance companies to seek more favorable conditions in other states, leading many to either pull out of California entirely or impose moratoriums on writing new policies within the state. (More Info) This has resulted in a lack of competition, leaving consumers with limited choices and increasingly expensive coverage.

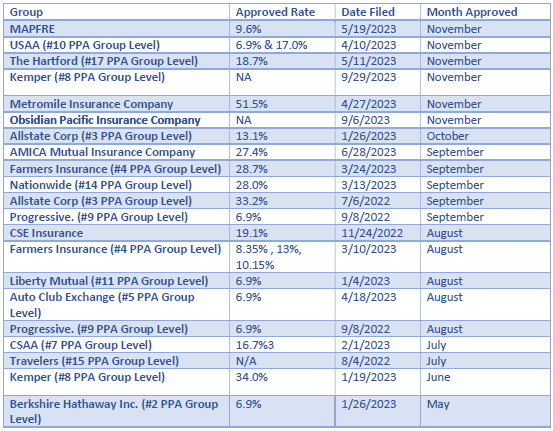

Below is a list of Auto Insurance carriers that have been approved to increase their rate in the last 6 months:

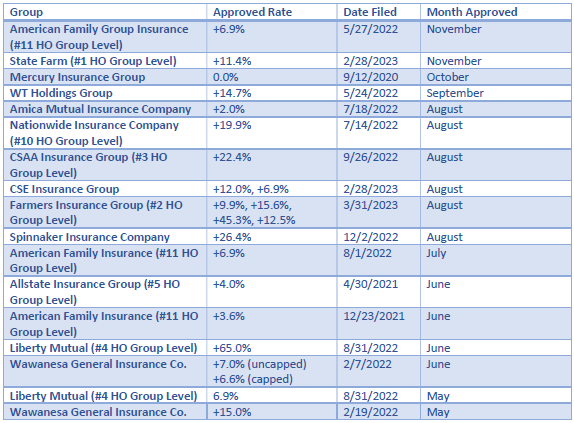

Below is a list of Homeowner Insurance carriers that have been approved to increase their rate in the last 6 months:

For more information on rate filings and the approvals, click HERE.

We cannot emphasize this enough, do not miss a payment or submit a payment late, and do not cancel your policy until a confirmed replacement has been secured.

Consumers can have their voice heard! Voice your opinion about the insurance crisis here in California to the Department of insurance by clicking HERE or call them at (800) 927-4357.