Commercial Property Insurance

from Allco Insurance

Commercial Property Insurance

As a business owner, your business premises are the lifeblood of your revenue. If something happened to your business property, such as a fire or natural disaster, how would you recoup your losses? Sadly, for many, that means digging into savings or even shuttering the business.

All of those unpleasant consequences are completely avoidable, however, with the right commercial property insurance. This coverage protects business buildings, including:

- Offices

- Warehouses and storage facilities

- Manufacturing plants

- Shops and retail outlets

- Restaurants

- Service centers

- Schools

- Nonprofit organizations

If your business is hit by a fire or storm, having commercial property insurance can get you back on your feet faster, with a minimum of interruption. Not only does this coverage protect your structures, but it also covers the contents inside as well, including office equipment, furniture, lighting, and inventory.

You can also add extra coverage for special situations:

- Business property that is taken off the premises

- Damage from floods

- Damage from earthquakes

- Business income interruption

- Electronic data processing (power surges and viruses)

Having sufficient commercial property insurance is part of a comprehensive plan to make sure your business is covered for emergencies and potential lawsuits, including commercial auto coverage, general liability insurance, umbrella insurance, workers compensation, and in some cases, bonds.

If you’re not sure how much commercial property coverage you need, we can help you out. Start with a third-party appraisal of your business buildings to determine what the replacement cost would be. Then add up your other business assets you can’t afford to lose, such as equipment and inventory.

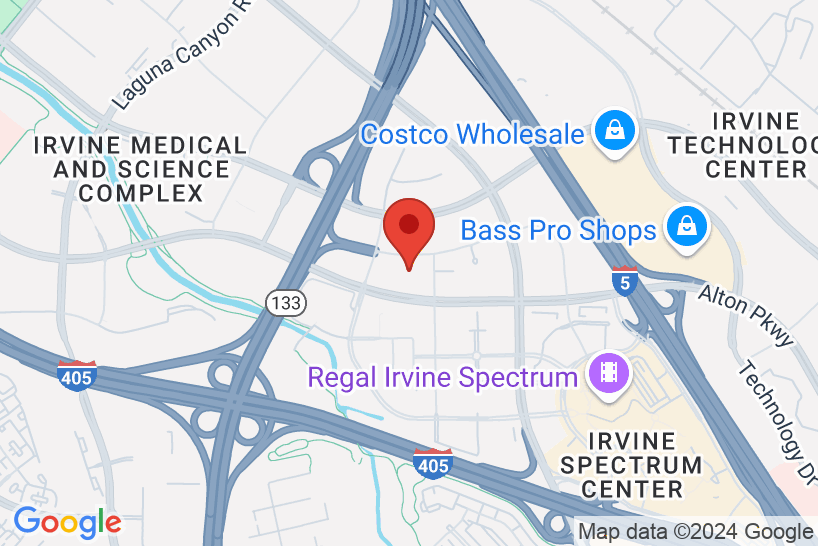

Next, give us a call at 714-992-2390. We at Allco Insurance are independent agents and therefore have access to a wealth of insurance products, which allows us to put together the perfect package for your one-of-a-kind business. We’re also a Dave Ramsey Endorsed Local Provider (ELP).

Don’t let your business go another day without the coverage you need to protect your hard-earned assets. Reach out for a chat today.

Get a

Get a